IBM presents z16, a solution that will prevent up to 32,000 million dollars of losses

With this system, the company seeks to impact industries such as the financial sector, where they would avoid losses of $32 billion due to fraud in real time.

Currently, fraud detection models run on less than 10% of high-volume transactions due to latency issues, according to a study by Morning Consult, so a large amount of fraud goes undetected and next-generation servers can address this problem.

Globally, real-time fraud cost the financial industry $32 billion in card losses during 2021. In this context, IBM presented its z16 generation of its mainframe, which includes artificial intelligence to improve real-time workloads within different environments, from finance to healthcare.

Mainframes are data servers designed to process up to 1 trillion web transactions per day, based on high standards of security and reliability. Their operation is essential for commercial databases, transaction servers and applications that require resilience, security and agility and are installed in the cloud, where the idea is to optimize workloads.

With z16, the company aims to help protect against threats that could be used to decrypt current encryption technologies. According to Elpida Tzortzatos, CTO of IBM Systems, the goal of reducing the amount of real-time fraud is a critical issue, as it is a problem that has advanced across different industries and business environments.

“Integrating and scaling artificial intelligence was a challenge, but when applied, consistent results are seen in the analysis of each transaction and the impact is millions of dollars, in addition to not losing profits,” he said during a press conference.

These are the features of z16

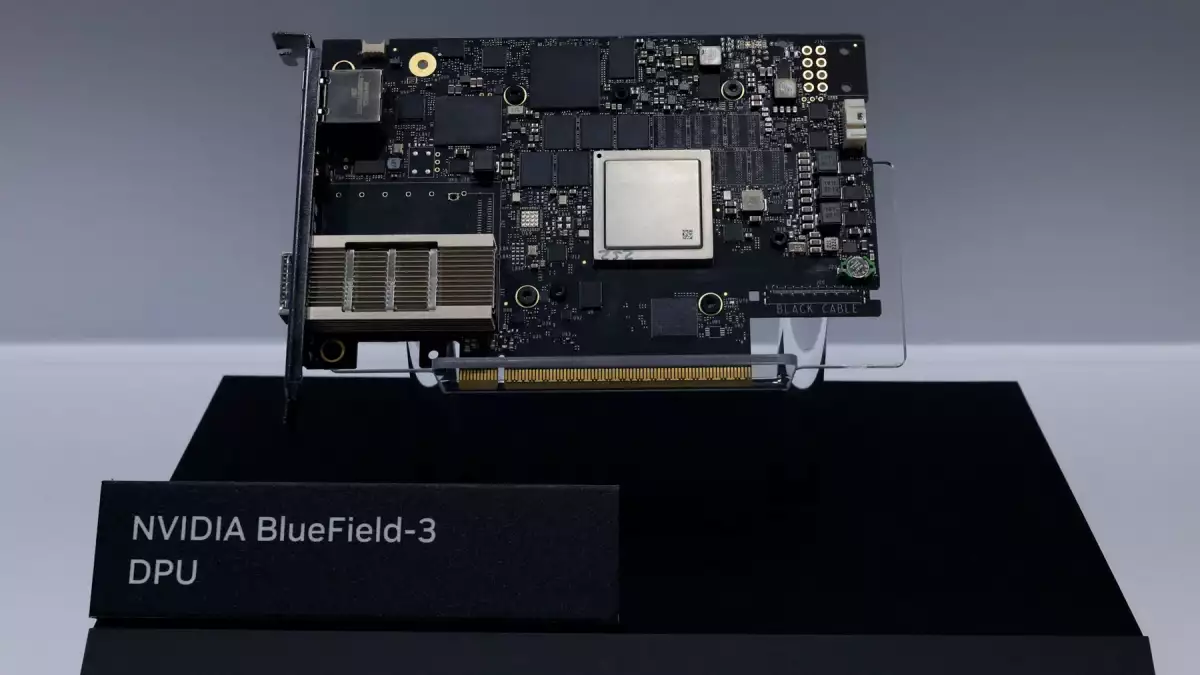

The z16 system leverages AI through its IBM Telum chip to securely process high-volume transactions. With this mainframe, for example, banks can analyze fraud during large-scale transactions, as it has the capacity to process 300 billion inference requests per day with just one millisecond of latency, according to performance test data.

“This is an extremely powerful infrastructure,” said Ross Mauri, general manager of IBM, who also described that its processing capacity will be greater in terms of AI and will even generate a change in relation to the z15 series, which has been on sale for 11 quarters.

For consumers, this means less time and energy spent dealing with fraudulent credit card transactions. IBM promises that for both merchants and card issuers, there will be less lost revenue as consumers avoid the frustration associated with false declines.

Quantum-safe data protection

Another aspect that IBM highlights for hybrid cloud environments, local resources and public cloud is security. In this regard, the technology company mentions that z16 aims to evolve based on advances in quantum computing.

Anne Dames, an IBM engineer focused on developing cryptographic technology, said that while there are actors seeking to take advantage of quantum computing for malicious purposes, with z16 they aim to take a step forward in protecting data, since at this moment clients are more exposed to information than ever.

The system will leverage cryptography to help clients, ranging from fintechs to edtechs, address future threats related to quantum computing, including “collect now, decrypt later” attacks that can lead to extortion, loss of intellectual property and disclosure of other sensitive data.

Leave a comment:

Tranding News